We usually have so many daily and occasional expenses that managing finances becomes a task. Add to that creating a monthly budget! But, if you get down to it and crack the code, you will realise it’s a pretty straightforward process and an efficient way to gain control over your money. A budget helps you keep your earnings in check, plan expenditures to meet your financial goals, and even set aside funds for future plans.

Whether you want to be financially safe during emergencies, regularly monitor Tata Motors share price and wish to avoid falling short when buying it, or have other plans, this easy-to-follow guide will help you create a budget so that you can be financially prepared at all times.

Step 1: Know All Your Earnings

The first task is to determine your monthly income, which includes all your earnings. Use your take-home pay (the amount received after deductions) for budgeting purposes and consider wages, business profits, along with money from any other source. If you have investments, use a CAGR calculator to know how much your investments are earning for you and factor that in as well.

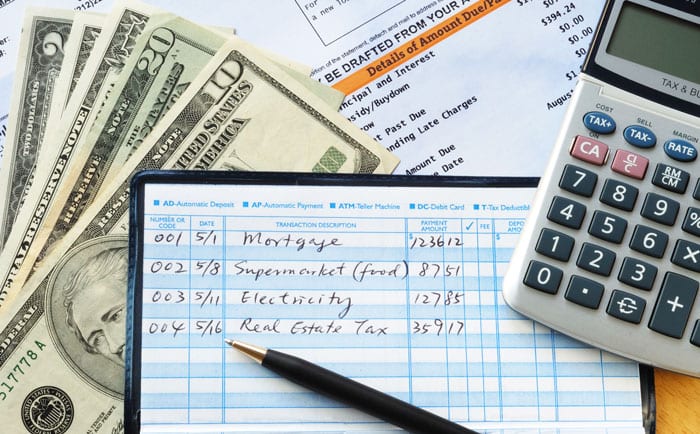

Step 2: Document Your Outlays

Next, list your expenditures. Start with fixed costs like rent, loan repayments, or insurance fees. Then, move on to variable expenses, such as groceries, electricity bills, transport, and leisure activities. Don’t neglect occasional costs like gifts or yearly memberships on various services.

This is also a perfect time to evaluate your spending patterns. If you invest in stocks, mutual funds, or other instruments, include the amount you put in these investments.

Step 3: Define Financial Objectives

What do you want to achieve with your money? What are your financial objectives? These may be short-term (such as a holiday) or long-term (like buying a property or saving for your retirement days). Having clear targets helps you stay committed to your budget and focus on saving or investing.

Step 4: Classify Expenses

Put your spending into two columns, namely, “essentials” and “luxuries.” Essentials will include all your necessities, such as rent, daily groceries, daily travelling, and medical expenses. Luxuries will include expenses on dining out, shopping, or buying gadgets. Allocating your funds thoughtfully across these categories ensures your priorities are in order.

Step 5: Formulate Your Budget

With all the numbers at hand, allocate a portion of your income to each category. A well-known budgeting framework is the 50/30/20 rule:

50% for essentials

30% for luxuries

20% for savings or investments

For instance, if you earn ₹50,000 monthly, allocate ₹25,000 for essentials, ₹15,000 for luxuries, and ₹10,000 for savings or investments.

If your investments include buying shares in the stock market or in the primary market, you must use tools like a CAGR calculator to help regularly check your portfolio’s performance.

Step 6: Monitor Your Spending

It is important to look at your expenses daily to ensure you remain within your budget. Write down your daily expenditures using different apps, spreadsheets, or a journal. This will give you a proper idea of where you are spending and also quickly show you where you need to stop spending.

Step 7: Adapt as Necessary

Circumstances can change, and your budget should adjust accordingly. If you get a salary hike or face unforeseen expenses, revisit your budget and make the required modifications. Flexibility is essential for maintaining a realistic financial plan.

Step 8: Establish an Emergency Reserve

An emergency reserve is a financial cushion for sudden expenses, such as medical emergencies, or job loss. Aim to save at least three to six months’ worth of expenses. This ensures you won’t need to rely on loans or credit cards during tough times.

Step 9: Focus on Investment Growth

Once you’ve taken care of your essentials and built an emergency reserve, shift your attention to investments. Regular contributions to stocks, mutual funds, or fixed deposits can enhance your wealth over time. For example, tracking shares like Tata Motors share price and diversifying your investments can yield substantial returns.

Step 10: Evaluate Your Budget Regularly

A budget is not a static tool. Review it each month to confirm it aligns with your goals and mirrors your current financial situation. This periodic assessment also allows you to celebrate milestones, like achieving a savings target or reducing unnecessary expenses.

Advantages of Budgeting

While budgeting may seem time-consuming at first, the rewards are significant:

- Clarity in Finances: You have a precise understanding of your spending patterns.

- Enhanced Control: It helps prevent overspending.

- Accelerated Goal Realisation: Whether it’s a holiday or stock investment, budgeting aids in saving for your aspirations.

- Reduced Stress: A budget prepares you for unexpected challenges.

Finally, budgeting isn’t about stopping spending altogether; it’s about making sure your money-spending habits is in line with your goals.